Identity Theft Awareness Week: Tips for Lowering the Hidden Risk After a Death

When someone dies, their identity doesn’t automatically disappear. And for families, that reality can create risks they never expected to manage.

In the weeks and months that follow a death, families are juggling grief, paperwork, and a long list of unfamiliar responsibilities. During this time, a person’s identity is often still active across financial institutions, government agencies, and digital platforms, quietly creating an overlooked window of vulnerability.

This risk is commonly referred to as deceased identity theft or “ghosting.” While it’s rarely talked about, consumer protection agencies consistently warn that it’s a real and ongoing issue—one that can add unnecessary stress and financial harm to families already navigating loss.

This Identity Theft Awareness Week we’re helping families understand the risks after a loss, and how to limit them.

Why Identity Risk Persists After a Death

When a death occurs, there is rarely a single system that updates all records at once. Instead, families must notify institutions individually—credit bureaus, banks, government agencies, insurers, and more—often with different requirements and timelines.

During this transition period:

- Credit files may remain active

- Financial and digital accounts may be unmonitored

- Government systems may not yet reflect the death

- Public records may update before safeguards are in place

It’s this gap, between public notice and institutional closure, that creates potential exposure.

Public Records, Timing, and Exposure

Public records, such as obituaries, probate filings, and death notices, play an important role in honoring life, informing communities, and supporting legal processes. At the same time, they can signal to those with bad intentions that an identity is vulnerable, as some systems may not have been fully updated yet.

Consumer protection organizations emphasize that the risk does not stem from memorialization itself, but from timing mismatches across systems. When accounts, credit files, or tax records remain active, identities are more vulnerable to misuse and fraud.

Being aware of post-death identity exposure risk allows families and professionals to act earlier and protect the estate, without changing how they memorialize or honor their loved ones.

Key Steps for Reducing Post-Death Identity Risk

While nothing can eliminate risk entirely, consumer protection agencies recommend several actions that can help reduce exposure:

1. Notify Credit Bureaus

Request a deceased alert with major credit bureaus and provide required documentation so new credit activity is flagged for review.

2. Monitor Financial and Government Mail

Unexpected bills, collection notices, or tax correspondence addressed to the deceased can be early indicators of an issue.

3. Secure Key Documents

Death certificates, identification records, and estate documents should be stored securely yet accessible, as they are often required repeatedly.

4. Track Notified Institutions

Keep a centralized record of which institutions have been notified and which still require follow-up. This can help prevent gaps.

5. Seek Trusted Guidance

Consumer protection agencies and estate professionals can provide support and guidance if identity fraud is suspected.

Awareness Is the First Line of Protection. Cadence is the Next.

Identity Theft Awareness is a reminder that protection doesn’t stop at life, it extends into how we support families after loss. By understanding post-death identity risk, acting early, and closing system gaps thoughtfully, families and professionals can reduce unnecessary harm during one of life’s most difficult transitions.

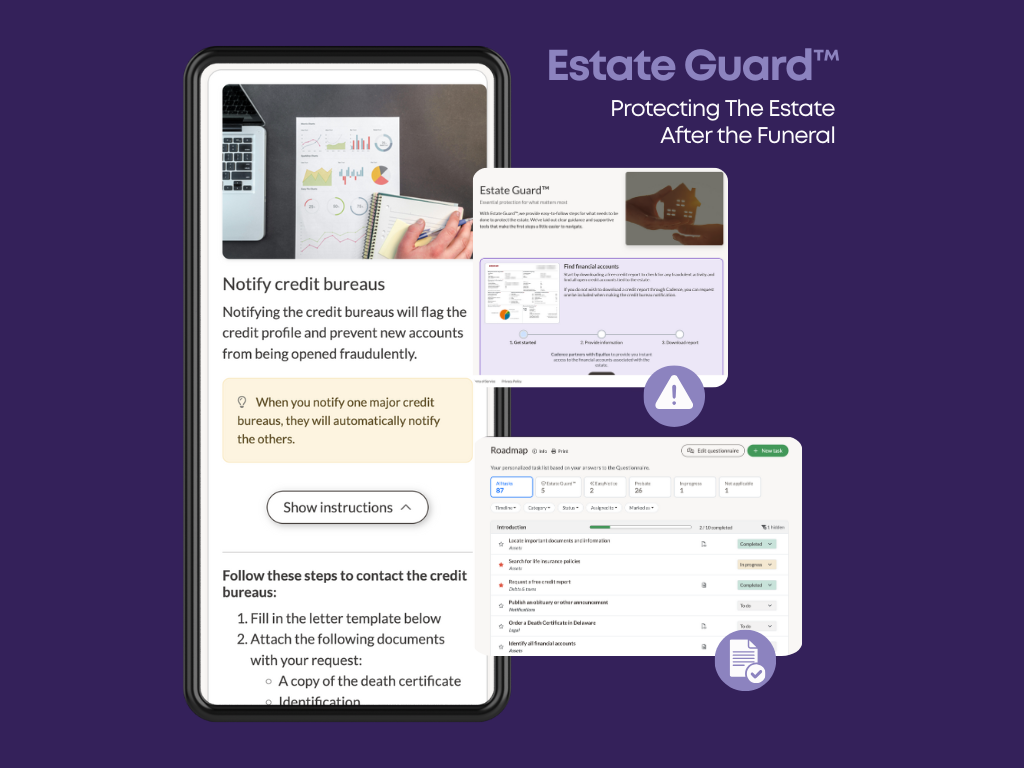

At Cadence, we created Estate Guard™ to help families identify potential areas of exposure after a death and take informed, timely next steps. Estate Guard is designed to bring clarity and structure to a complex, often fragmented process, supporting families with a smoother path and easier coordination during a difficult time.

See how Estate Guard™ helps protect the families you serve →

Sources & Further Reading